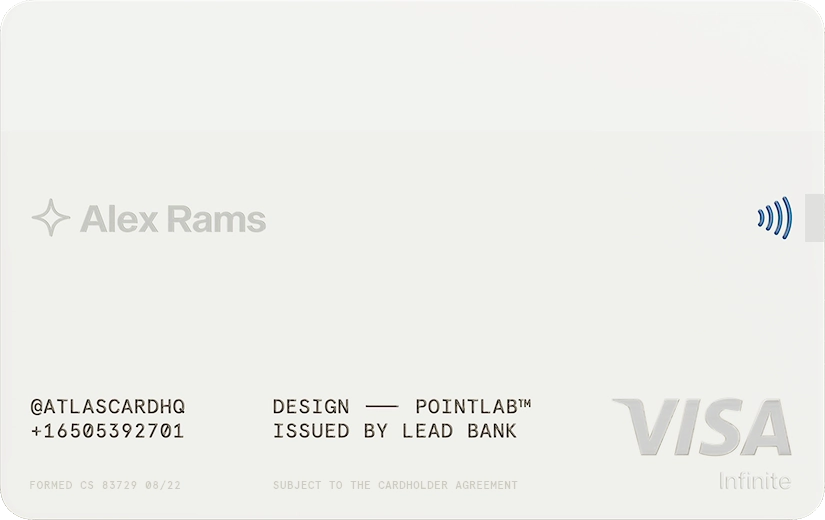

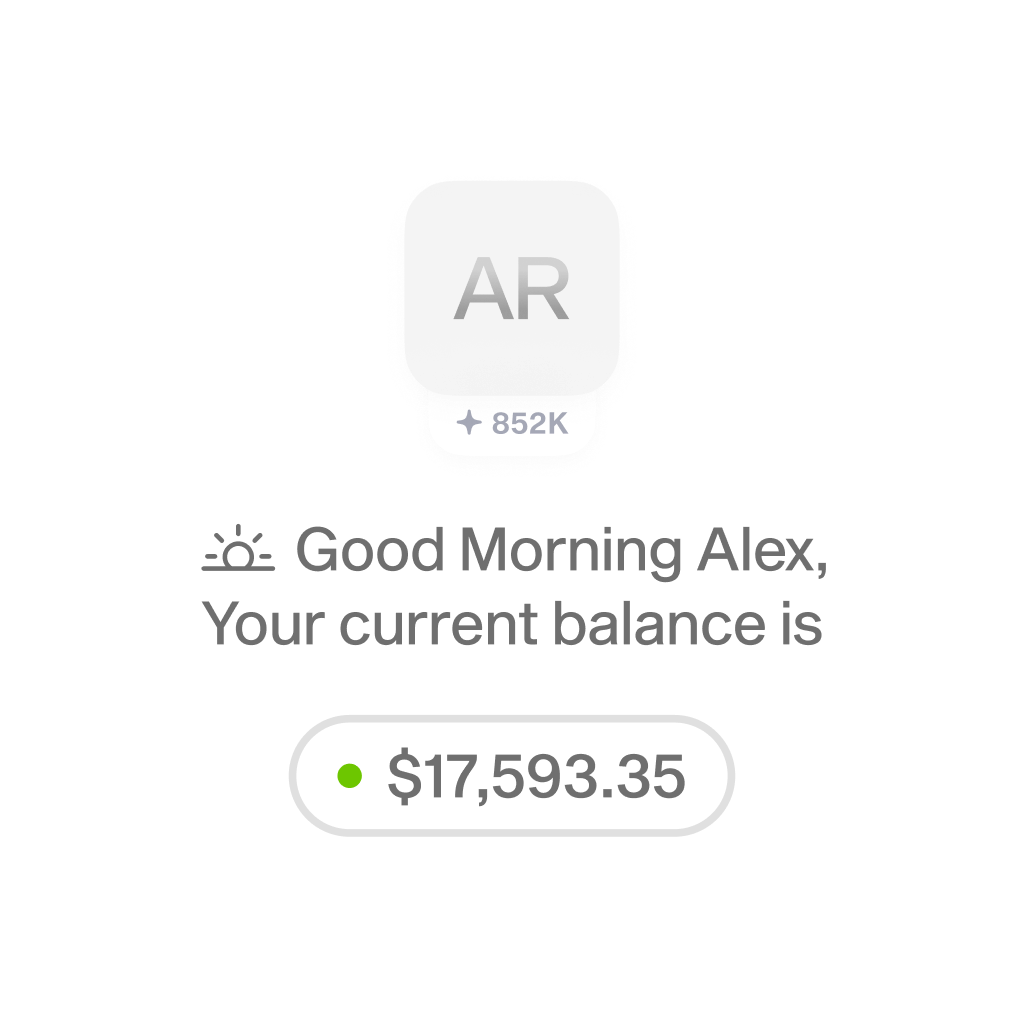

With Atlas, you can finally get tables at the hardest-to-book restaurants, find the perfect suite at the world’s

best hotels, sit front row at sold-out concerts and sporting events—and much more. All seamlessly brought to you

inside a card and app that’s as intuitive, as it is powerful.

Atlas membership is invite-only. Join the

waitlist and we’ll contact you if it’s a fit.